Trading failed auction and poor breakout is a strategy

May 11, 2022

No Comments

As with many trades, the same setup can be successful in varying degrees; ordering flow or a technical move prior to the setup can increase its chances of success. Looking to break bad highs (ones that have been tested multiple times) allows for more risk in your preferred setup when you decide that now is the time to go. A Trading failed auction occurs when the second hour of trading breaks the Initial Balance, then fails to continue and trades back inside it; from this technical move, we learn that sellers have been caught selling lower down, and their buying back of positions can assist the break of poor highs at 7109. This Axia daily debrief takes a detailed look at the Trading failed auction and the different means of executing the breakout Trading failed auction.

Theory of Trading failed auction:

Twitter, Youtube, Instagram, and others are the social media sites you use during the day if you are interested in technical trading. Traders who enjoy sharing their opinions on the market are likely to be found on these forums. This is a very supportive market. Most retail traders do not understand why the markets they trade are actually moving. This indicator indicates we have just retraced to this level, so we have headed up again. The majority of traders do not understand order flow dynamics even though RSIs, moving averages, and supports and resistances look cool online. The article is about how to understand order flow dynamics. There are three parts to it. As both are integral components of auction market theory, the second part covers the market profile and the third part covers the volume profile. For a comprehensive video guide, read the rest of this blog or join the Tradingriot Bootcamp. For those looking for a crypto futures exchange, I can trade crypto futures on By bit.

What is Auction Market Theory:

Auction Market Theory was developed by J. Peter Steidlmayer. In his book Mind Over Markets, Jim Dalton contributed to Steidlemeyer’s ideas by recognizing their value. Trading failed auction and poor breakout is a strategymarket theory that analyzes how market participants interact in order to achieve the primary purpose of the market. Financial markets are no different from any other auction where buyers and sellers meet on a daily basis. There are two major goals. Promote trade in the two-way auction process Discover the fair value of the asset Auction market theory translates this process through supply and demand dynamics and price discovery. The end of the up auction is followed by the beginning of the down auction in a two-day auction. Tools like Market Profile and Volume Profile serve as indicators of this process. Sixty-eight percent of these bell-shaped curves represent one standard deviation from the mean. We call this the Value Area.

Using Auction Market Theory to explain the financial markets:

Let’s consider a hypothetical example in the stock market, where one share of Samsung is valued at $50. Samsung comes out with a new phone, but it’s terrible; the battery doesn’t work, it’s overheating, etc. As a result of this event, Samsung stock begins to drop in its value until it finds new buyers at, say $30 per share. There is a new area of value created as a result of this event. Phones begin to get repaired after some time, and the stock price starts to rise again. What is likely to happen next? The stock price was around $50 previously. Eventually, all markets do this as participants negotiate between balanced and imbalanced values. According to Auction Market Theory, a Value Area is an area where 68% of the volume has been traded. The Inside Value area is also a point of control; this is where the most volume is traded or where the most time is spent.

Acceptances and failed auction:

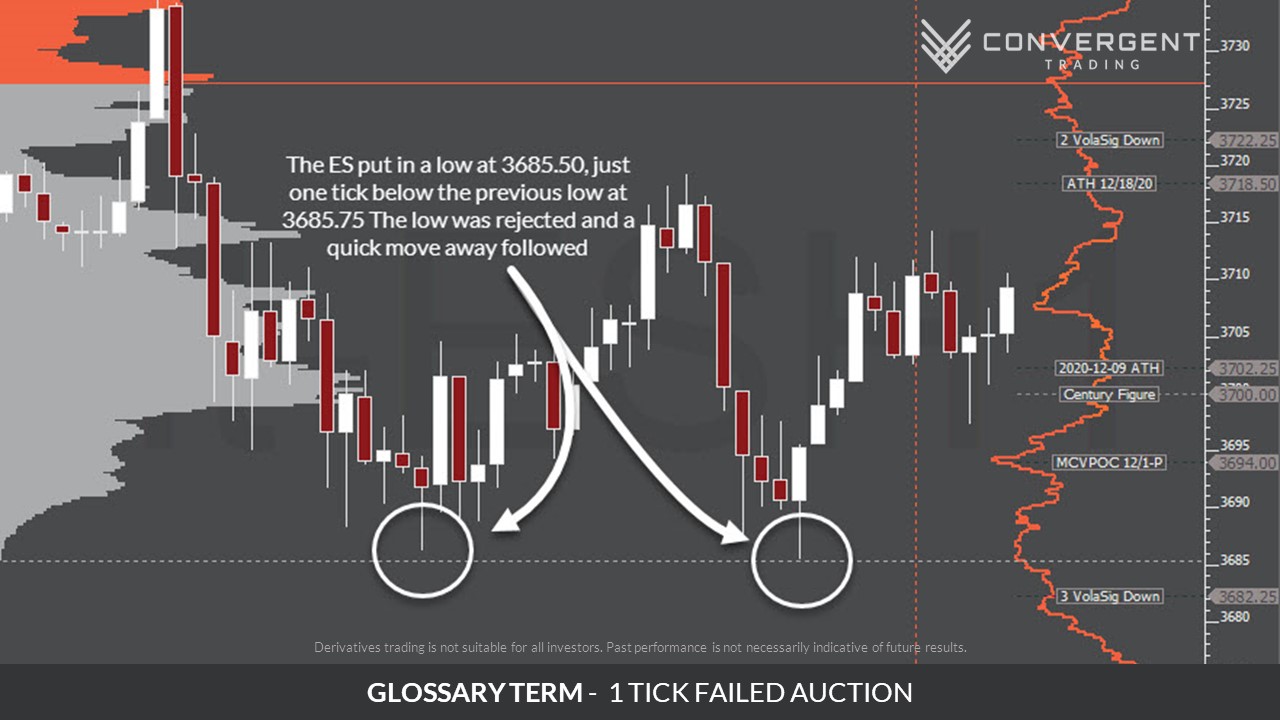

Although initiative and responsive activity are more of a theory, we can pretty quickly determine if new prices are being accepted or not. If a price breaks fair value with significant trading volume and convincing price action, we can expect new prices to be accepted above or below fair value. For those traders who trade price action, these are typically the support/resistance flips with enough time and space before the retest. It tells us that the market participants agreed on new prices, and we can expect the continuation once the old value area is tested. A Trading failed auction occurs when prices go outside of the value and fail to gain acceptance. There is no increase in volume on the breakout, and we see long wick and quick returns back to the point of breakout. These are often the V-shaped reversals back to the levels.

What does a Trading failed auction mean:

A Trading failed auction is often a successful trading pattern in the market profile. A pullback occurs when the Initial Balance (first 60min high – low) is taken out, followed by price action away from the Initial Balance within 30mins as shown below. A failed auction occurs when the Initial Balance (IB) break zone is not held for more than 30 minutes. The initial price reaction to the failed auction zone next Tuesday is likely to be the opposite, and later the failed auction zone is expected to be revisited within five days (according to Ray Barros). Trading this pattern towards the failed auction zone provides traders with an excellent opportunity to make profits.