Using The Choch Pattern For Trading

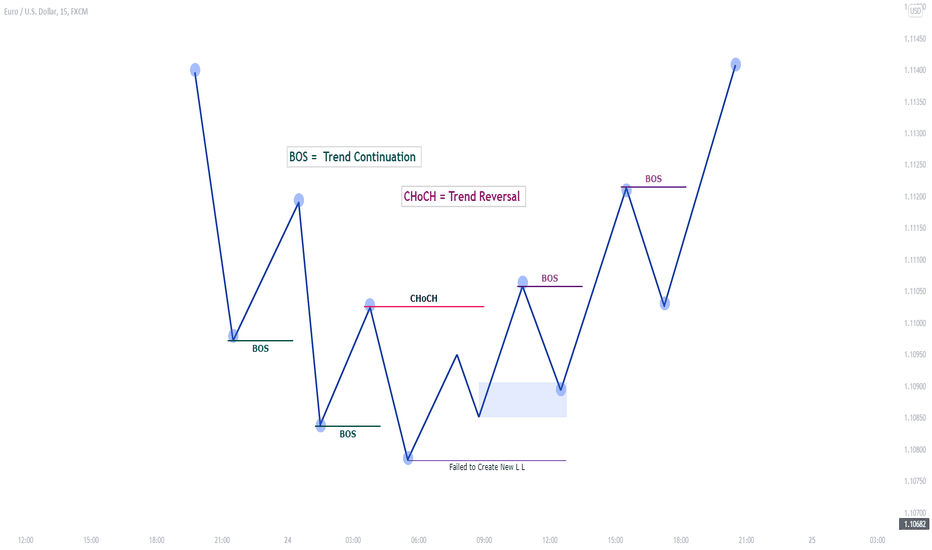

Changes in character confirm entry and exit into and out of the trading range Choch Pattern. The change in conduct within the trading range is one of the indicators we can use to predict a change in character. Here are the keys to trading CHoCH patterns.

The term “Choch” refers to a change of nature in the market. In an uptrend in the crypto market, with higher highs and higher lows, we can conclude the general trend is still positive. In the event that a new high is quickly broken to the downside, this could indicate a possible changeover in the bullish trend. Choch Pattern

The Choch pattern of trading

Crypto traders who grasp this concept can detect changes in market patterns and, as a result, make better trading decisions. When traders pay attention to market activity and respond appropriately, they may increase their chances of executing successful transactions on the crypto market. CHoCH is not arcane at all, it simply refers to the fact that the crypto market has changed over time and that all traders should keep this in mind when trying to make the most of their trading opportunities.Choch Pattern

What You Need to Know About Chart Patterns

A friend of mine has been able to model chart patterns using a complex computer algorithm, so I have done a much more in-depth analysis of patterns with him. It is now possible to identify profitable chart patterns and verify their efficacy.

The most profitable long-term chart patterns

We examined around 60,000 trades on the Australian Stock Exchange and found the following results. It should come as no surprise that the most profitable patterns to trade are the long-term ones. In general, ascending triangles, symmetrical triangles, and rectangles can be traded quite profitably if they break to the upside. The broadening descending pattern and the broadening ascending pattern are also profitable long-term trading patterns which are less well known. In around 10 days, they return more than 1% per trade on average, with a success rate around 50% using a tight stop loss. In our testing, we found that an ascending wedge, which is widely regarded as a short pattern, actually performs well when traded long.

The most profitable short chart patterns

By trading CFDs, I am able to trade patterns both long and short. In short-term trading, the most profitable chart patterns tend to be the descending triangle and broadening ascending pattern. About 45% of these patterns are profitable, with an average return per trade of 1% in around nine days. For other patterns to be successful on the short side, market conditions must be supportiveAsymmetrical triangles, ascending triangles, and rectangles can also be traded short very successfully with similar results as the other profitable chart patterns in all market conditions.s. Ascending triangles and broadening ascending patterns usually perform even better in falling markets.

Patterns of pricing:

By identifying price patterns that tend to repeat themselves over and over again, you can be able to predict future price movements. The following is a good start for a profitable trading strategy, however it has the same flaw as the one above. Consistent gains in the markets cannot be achieved by simply using price patterns.

Indices:

Anyone aspiring to become a trader must learn this first. There are many different types of indicators available, the most popular being MACD, stochastics, RSI, and Moving Averages. While there are several distinct ways you can apply signals provided by these various indicators, beginners usually learn the hard way that indicator-based trading is not enough and that it is only a component of a more comprehensive and sophisticated trading system.